Bitcoin Lending: the Investor’s Perspective

As Bitcoin evolves, some of its underdeveloped features start showing up. Investing instruments are one of such, and similar to fiat-based alternatives there are different levels of risk and return around them.

Holding their Bitcoin seems to be enough for many people, who believe that thanks to its fixed supply, Bitcoin will become scarce in the future and as the demand grows the price will rise as well. But, besides missing what could be the opportunity to earn even more by investing their cryptocurrency, those persons are also playing against the principles of Bitcoin by pegging it to fiat.

Saving accounts already exist, with annual rates between 1 and 2%, which for an essentially deflationary currency that does not sound bad at all. But considering such accounts are not risk-free either, as you are trusting your BTC to a third-party, why not to do something smarter with it?

Among the earning opportunities, one that does not require lots of capital or specific knowledge to get involved is P2P lending; you only need to head to any of the existing lending platforms, deposit some BTC, carefully select a few loans where you want to invest and wait for the repayments to come.

Why should you lend your BTC?

The basic reason is the potential of earnings: the estimated annual average return is around 10%, at least 5x higher than what you would get from a savings account. But at the same time, by lending your BTC you are contributing to raise the awareness about cryptocurrencies and helping a small business to take off, a BTC merchant to fill his orders, an individual to sort out his financial problems and, in general, someone to have the money he needs and that would probably not get otherwise.

Bitcoin lending is also a new market, with huge potential to grow. You are in front of a life-changing opportunity, and fiat-lending websites can confirm that as they already passed this stage a few years ago.

What are the risks?

Of course return is proportional to risk, and nicer profits mean things will statistically go wrong more often.

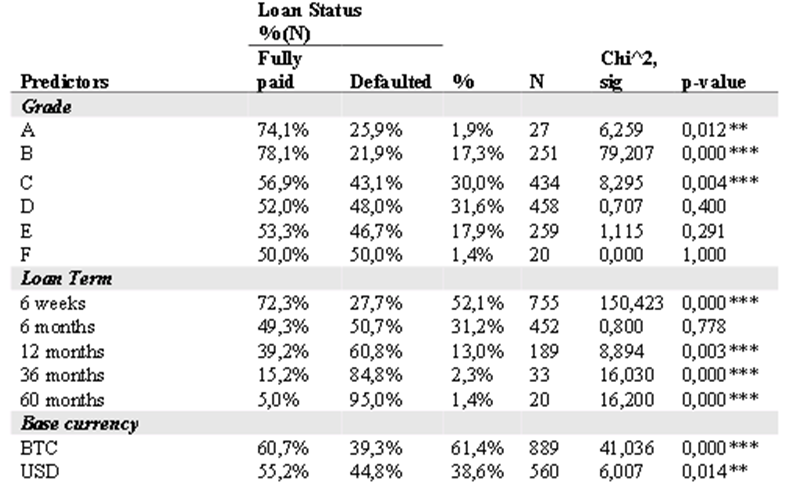

A recent study analyzed data from BitBond, one of the top BTC lending sites, and showed that default rates are particularly high due to the novelty of lending cryptocurrencies. According to the conclusions, safer loans by the time are short term ones to people with solid profiles (A and B ratings on BitFinex).

Default rates on BitBond, as presented on “Determinants of default in the bitcoin lending market: The case of Bitbond platform” (Noreikaite & Ambrazaite, 2017).

The study also questioned the effectivity of traditional credit scores, and highlighted how taking into account soft variables is important to avoid being defaulted, a positive point for BTC P2P loans. It also stated that as the market stabilizes, lending will become more profitable and secure.

The default rates were estimated in the range of 20 ~ 30%, but the study analyzed raw data with no filtering strategy applied to screen the loans before funding them. In case of a default, most websites will disclose the borrower’s personal information with you, so that you can pursue legal actions. Some sites alternatively pass the debt to a collection agency.

Tips for lending your Bitcoin

- Spread your loans over different borrowers: never forget the investment principle that states not to put all your eggs in one basket. Investing all your money in a single loan might be tempting as it will be easier to track and the compound interest will work in your favor, but if the borrower defaults you will be in a terrible position.

- Analyze every request and search for safe borrowers: carefully read the details, get a clear idea of who the person behind it is, if you are unsure about something just ask! Remember that soft variables are more important than credit scores or ratings.

- Stay away of auto investing: it simply does not match your strategy of meticulously picking whom to lend. Bots are not smart enough to detect inconsistent requests.

- Avoid bigger loans: this is related both to tip number 1, by not letting a particular loan to consume a significant part of your lending budget, but also helps you about exit scams. Given how reputation systems currently work, it is common for scammers to build a positive history by repaying smaller loans before requesting the one they will default at.

- Ratings are not perfect, but trust them: if a user has a negative feedback or a low trust rating, do not believe any stories and simply do not deal with him. The odds of it being justified are low, as most honest people would pay close attention to their online reputation. This also applies to users with unpaid previous loans. Newcomers are also a risky choice, someone has to take the risk but do yourself a favor and do not be that one.

- Invest only what you can afford to lose: probably you have read this one in every article about investing, but guess what? it is true! if you want “risk-free” options, put your BTC into a savings account or better hold it in your personal wallet.

- Keep track of your activity: you cannot rely on your memory to keep track of your loans, as the number of them increase you will start forgetting about them and won’t realize your profits / losses (and that data is important for later decision making).

- Enable 2FA and any other extra security measures: remember there is money in play, 2FA still stands as an almost unbreakable additional security step, but do not limit yourself and use every extra layer of security you can.

- BTC loans in BTC: more advanced users may decide to peg their loans to a different currency, in order to take advantage of a favorable market movement (i.e. Bitcoin price fall); but if you are not one of those and do not feel comfortable with an additional level of uncertainty, keep things simple.

- It helps if you understand what are you lending for: common reasons to borrow include starting or expanding a business idea, trading cryptocurrencies, mining activity and personal reasons (paying debts, going on vacations, personal expenses, etc.). If you know about the topic, you will guess with some certainty if the borrower will have success or fail and lose your money.

Conclusion

You will find a lot of negative comments about bitcoin lending on the internet, with some people claiming it to be a scam all along. Most of the time those messages come from people that were not careful enough and got ripped off, or victims of ponzis or similar schemes which end with a negative position towards Bitcoin in general.

Most Bitcoin p2p lending websites are solid companies, with honest people behind them and, while profits cannot be guaranteed, there is no reason not to give these platforms an opportunity based just on mere random opinions. Invest smartly and you will find how earning from lending is possible, how it can be a tool to further improve your portfolio!